DeFi protocols

The first generation of defi applications allows users to swap various tokens without the need for traditional intermediaries like exchanges. It enables users to trade tokens directly from their cryptocurrency wallets through smart contracts. Users can become liquidity providers by depositing pairs of tokens into liquidity pools. In return, they earn fees from trades.

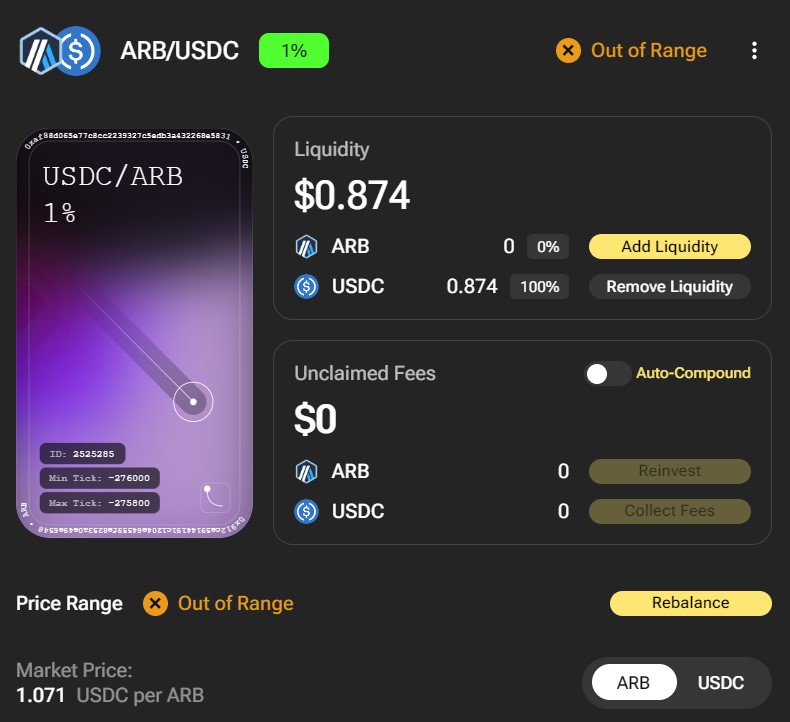

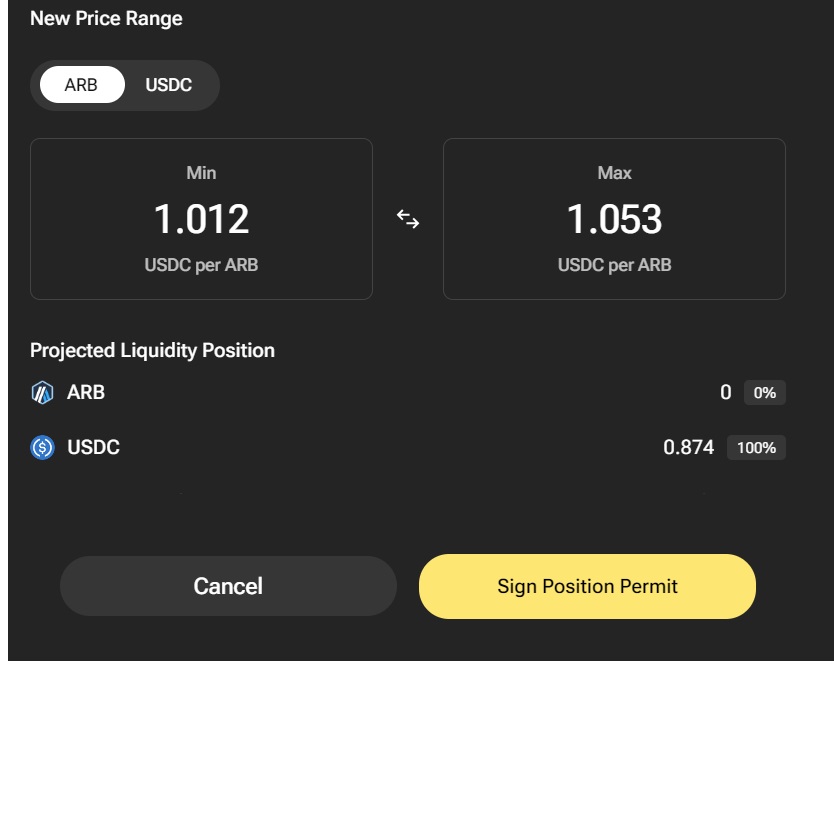

This is an efficient way for users to earn a yield on assets they already own, however there’s the risk of impermanent loss. If a token price drops significantly , the liquidity provider ends up holding the asset with the least value. Most of the defi protocols now lets the users specify the price ranges they are comfortable with. If these prices are exceeded, the user exits the pool automatically. While this helps protect from impermanent loss, it takes more management and monitoring. When a users exits the pool automatically, he stops earning yields. The users have a choice to enter managed pools where a 3rd party would rebalance and manage the pool for a small fee.

Pool managing tools

New tools like Aperture helps users to manage pools from different providers. It offers an “intent” infrastructure where users declare their goals and the platform executes them. It offers automatic rebalancing strategies, automatic fee compounding and much more. There is an airdrop campaign ongoing where you can earn points while interacting with the protocol. We recommend doing an extensive research before using the platform. You need to understand the smart contract risks associated and understand how the “position permit” signatures work. Here’s an example of a rebalancing.